POTASH MINING

Michigan Strategic Development Fund is considering granting private activity bonds using public money to Michigan Potash Company.

Questions for MSF Board RE: Michigan Potash and Salt Company Private Activity Bond Proposal:

- The “Inducement Resolution” adopted by MSF for this project contains assertions drawn verbatim from MPSC’s application materials. Were those assertions independently verified? Has the economic viability of this project been independently evaluated, based on data other than the applicants’ assertions?

- Are you aware of the 25-year history of efforts to mine this potash deposit by large, long-established and well capitalized mining companies? Why did those experienced mining companies give up on these potash deposits, and what evidence has been presented to show that an inexperienced start-up company, with “no official employees” can succeed where corporate giants have given up?

- The huge, established potash mines just across the border in Saskatchewan have easy access to efficient rail transport. The proposed Michigan Potash project will transport exclusively by truck. What evidence is there that Michigan farmers would actually experience significantly lower prices for potash?

- Given that potash prices in 2022 have declined considerably, and that analysts predict continuing declines in price, has MPSC revised its economic projections to consider reduced global prices?

- MPSC’s financial projections assume potash output of 800-975 thousand tons per year (kt/y), yet their water withdrawal permit was based on projections 650 kt/y.2 How can they proceed without permits allowing them to draw sufficient fresh water to support their process?3 Has MSF or Citi Group received any evidence that the area’s aquifers can sustain the amount of water that would need to be withdrawn?

- MPSC projects that it will produce approximately 1 million tons of Sodium Chloride (salt) annually as a “beneficial co-product” of the potash refining process. But, because Michigan already produces more salt than it uses, they hope to export their co-product out of state “market bearing.” Is there evidence that those out of state markets even exist?

- Any salt MPSC is unable to sell is no longer a “beneficial co-product” but becomes toxic solid waste that must be redissolved in fresh water and disposed of deep underground, polluting, then removing that fresh water from the hydrologic cycle into perpetuity.4 Is it correct to say that by issuing these Private Activity Bonds, MSF is lending the state of Michigan’s good name and reputation to underwrite and encourage pollution, impairment and destruction of a public trust resource of the state?

- How will MSF justify underwriting and encouraging this development without first knowing how much of a public trust resource would be destroyed in the process, and whether that sacrifice is warranted to create a mere 129 permanent jobs?

- Huge Canadian mines have dramatically ramped up production capabilities in response to pandemic and Ukraine war-induced market disruptions. There is not, today, a potash shortage. What evidence has MPSC presented that global prices will remain sufficiently high to support their income projections? What evidence is there that the market is not correcting to reassert chronically low potash prices (from world-wide industry over-capacity)?

- The US currently imports 85% of its potash from Canada. How will MPSC compete successfully against Canadian mines operating on a massive scale, in a much safer environment, and which enjoy direct rail access to America’s agricultural heartland?

- Will MPSC receive its loan from the State of Michigan prior to the sale of these bonds, or will the loan be contingent on the sale of those bonds?

- Will MSF’s decision consider environment, social and governance (ESG) factors? Does Citi Group Global analyze those factors in its underwriting decision? Has either MSF or Citi Group balanced the creation of 129 jobs against the real risk that well over 100 square miles of highly vulnerable terrain could be subjected to widespread environmental disruption and destruction? Or that residents may lose their sole supply of fresh water due to direct competition with the needs of a large solution-mine?

- The project will be sited on rolling terrain, dotted with small wetlands, springs, creeks and seeps. At full build-out, it will require miles of high-volume brine pipelines continuously operating at 2000 psi over that terrain. Pipeline leaks are a known risk for solution mining operations.5 Considering the scope and geography of the projected 15,000 acre minefield, these pipelines will periodically be disassembled and transferred to new locations as new wells are constantly being drilled. Has either MSF or Citi Group factored in legal liability for operating a risky enterprise over such scattered, vulnerable and poorly suited terrain?

- Despite repeated requests, the Osceola Planning Commission has been given no information on where and how the company plans to establish its brine pipelines and access roads, or how they plan to traverse private lands and public roadways. Further, they have not revealed any plans or procedures for dealing with brine contamination emergencies. Has MSF communicated with the Osceola County Planning Commission about the project and the impacts it will have on the area’s residents and public infrastructure?

- While investors will bear a financial risk of default, should the project prove non-viable, local residents will likely be left “holding the bag” for aquifer depletion, groundwater contamination and other environmental damage in the event of bankruptcy. Neither EGLE nor EPA recognize any obligation to clean up contamination or to deal with destruction of area aquifers and domestic water wells. As a condition to issuing private activity bonds, can the MSF require the borrower to post an “environmental performance bond” to make whole those who might sustain economic injury in event of bankruptcy?

1See https://www.dtnpf.com/agriculture/web/ag/crops/article/2022/12/22/2023-potash-outlook-see-supply-lower: According to Samuel Taylor, inputs analyst for RaboResearch, the price outlook for potash in 2023 could be considerably lower. "I think we very easily could see a 25% to 30% decline in price on potash fertilizer in the U.S. in 2023," he is quoted as saying. Another analyst, Josh Linville, director of fertilizer at StoneX, said he also expects potash prices to slip in 2023: “Demand into the new year will struggle to overcome the downturn seen in 2022.” Linville said the potash market might even enter an oversupplied situation in the near future. "It is certainly a bearish situation (for prices)," Linville said.

See also: https://www.agriculture.com/news/business/new-report-predicts-more-stable-fertilizer-markets-for-20232 Michigan Potash Company originally registered with the state to withdraw 1,200 gallons per minute. Their announced potash output has nearly doubled since then.

3 MPSC has not published any studies affirming the capacity of local aquifers to sustain its operations at any production level, nor has it publicly announced how much fresh water their process will consume. Studies conducted in New York State show that sustained solution mining can and does lower the water table enough to significantly change the local environment.

4 Salt is an unwelcome by-product of the potash solution-mining process. It will be a significant problem at MPSC’s location, where the ore deposit exists as a very thin layer embedded within in a massive salt deposit. Disposal of excess will require tremendous quantities of fresh water on top of the already massive consumption from the mining process itself.

5 “Because potash solution mining relies heavily on pumping water underground, there are environmental challenges that miners need to take into account. The process itself is intensive in terms of water usage, and the contamination of nearby water sources like aquifers is a real risk if solutions leak.” [Agriculture Investing News, 8/21/18]

Potash Mining Home

Solution-Mining Basics

History of POTASH Mining

Economics

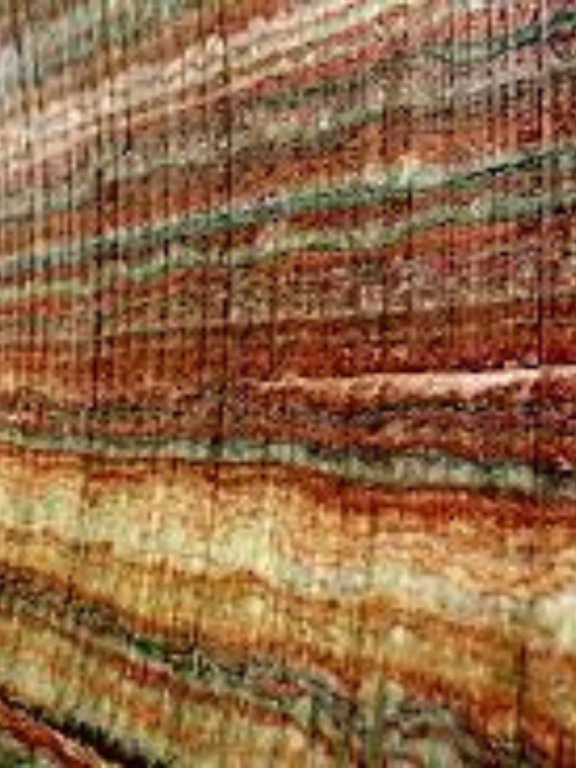

The "Ore" Body

Water Withdrawal

Well-spacing, Pipelines, & Sprawling

Terrain, Sites, & Brine

Gray Site